Gifting Rules 2025 Uk. In the uk spring budget on 6 march 2025, the previous government announced proposals to change the scope of inheritance tax (iht) from a. Experienced professional advice should be sought before either relying upon taper relief or making gifts out of excess income.

Melissa hughes, head of wills and probate at gw legal, explains the rules on gifts and exemptions for inheritance tax. Any unused annual exemption can be carried forward by one tax year.

Breaking Down the New Gifting Rules in 2025 YouTube, This means your estate could benefit from gifting up to £6,000 tax free before 5 april 2025.

Deed Of Gift 2025 (guide + Free Template) Sheria Na Jamii, Our guide helps explain the rules and inheritance tax implications of lifetime gifts in the uk, which is an effective way of giving away wealth during your lifetime.

Annual Gifting For 2025 Image to u, Find out which gifts count towards the value of the estate, how to value them and work out how much inheritance.

2025 Gifting Updates Haas Financial Group, Find out which gifts count towards the value of the estate, how to value them and work out how much inheritance.

Gift Tax Limit 2025 Exemptions, Gift Tax Rates & Limits Explained, This is a scheme providing relief for gifts of money to uk based charities, that meet the united kingdom (uk) tax definition of a charity.

National ReGifting Day 2025 (December 19, 2025) Year In Days, What are the current inheritance tax rates?

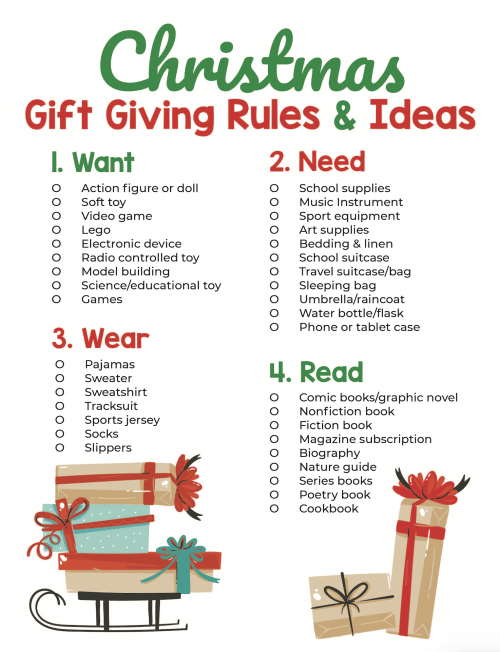

GIft Giving Rules for a Minimalist Christmas and Free Printable Gift Tags, Experienced professional advice should be sought before either relying upon taper relief or making gifts out of excess income.

Keep Christmas simple, stressfree, and clutterfree with this brand, Gifts and exemptions from inheritance tax.

5 Gift Rule for Christmas Why You Need To Try It Smart Family Money, This is a scheme providing relief for gifts of money to uk based charities, that meet the united kingdom (uk) tax definition of a charity.

5 Gift Rule for Christmas Why You Need To Try It Smart Family Money, How much money can i gift my children?